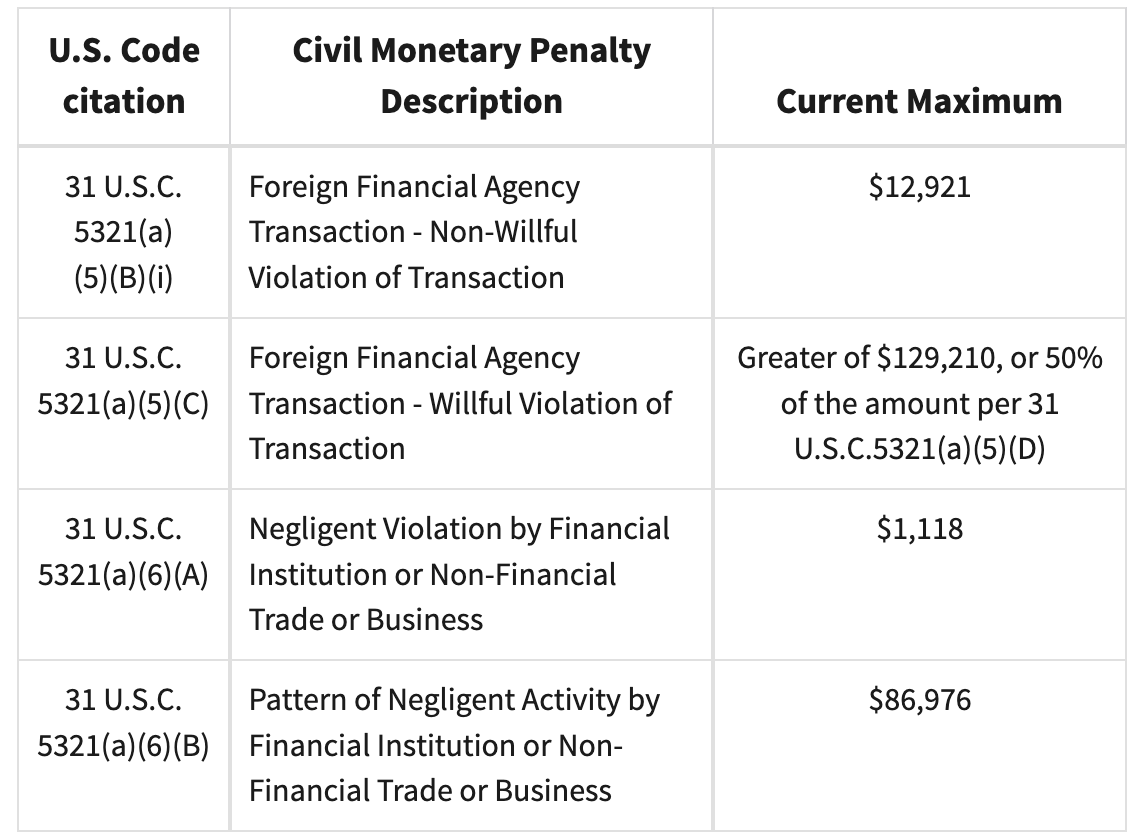

The penalties for not filing your FBAR could be substantially higher than penalties for not filing your federal US tax return. If you haven’t filed FBAR, you could face serious penalties or even imprisonment. What are the penalties for not filing FinCen Form 114 (US FBAR form)? A further extension to file your federal tax return will also automatically be granted if you file for such an extension by June 15th as an expat. The regular deadline for filing your FBAR is April 15, however, for expats an automatic extension to file your federal tax return is granted to June 15th, and the FBAR deadline follows this. In 2017 the filing deadline for FBAR has been synchronized with the federal tax return deadline. All bank accounts, security accounts and retirement accounts need to be reported are subject to FBAR reporting.įor example, if you have two bank accounts, each with a max balance of $5,000 during the year, then you need to disclose these accounts! When do you need to file FBAR as an expat?

The reporting requirement is triggered if the aggregate value of those foreign financial accounts exceed $10,000 at any time during the calendar year. Expats are required to file an FBAR to report their financial interest in (i.e., ownership), or signature or other authority of an account located with a foreign financial institution. If you are an expat you most likely have a foreign account for your daily banking transactions. The foreign financial accounts subject to FBAR include all checking, savings, and investment accounts, including most types of foreign pensions, but excluding mortgages and hedge funds. What foreign financial accounts need to be reported? No tax will be imposed, but there are strict penalties for non-compliance (see below).

Rest assured, Form 114 is only for informational purposes. This law was introduced to identify foreign financial accounts held by US persons in order to prevent offshoring of assets and income. This report is known as FinCEN Form 114 – Report of Foreign Bank and Financial Accounts (“FBAR”). Since 1970, the US requires citizens to file an informational report annually to disclose their non-US foreign financial accounts. This article gives you an overview of the basics of complying with the FBAR rules, and covers what the FBAR entails, who needs to file, what needs to be reported, when the FBAR needs to be filed, and the consequences of not filing. As a US expat, you may or may not know that on top of having to file your federal tax return every year, you may also have to file FinCen Form 114, or the “FBAR” as well.

0 kommentar(er)

0 kommentar(er)